Now that we are in a new year, we are looking ahead to see how 2023 may evolve. While no one has a crystal ball, there are some likely opportunities this year that may impact the planning we are doing with you. Below are a few key items to consider in 2023.

Is a recession likely and what you can do to protect yourself when one occurs-

Many industry professionals and media members seem to agree that a recession is likely to occur in 2023, though no one is certain of this, and the actual impact is difficult to know. Regardless of whether there is a recession this year, here are a few ways to get your financial house in order to better protect you in the event we see a recession.

1. Make sure you have an adequate emergency fund in place-This is essential in preparing for the “what ifs” and can provide cash flow if there is a job loss or disruption in income.

2. Create and implement a budget- Having a good understanding of what is coming in and what is going out is a great place to start. You should understand your fixed and discretionary expenses in case you need to reduce your costs.

3. Pay down high interest rate debt- This will save you from excessive interest costs and can also help free additional cash flow.

How can you navigate volatile markets-

The start of 2023 witnessed positive performance on most stock indices through the month of January, but as with most years we are bound to see an uptick in volatility and potential market losses at times throughout the year. When volatility it is important to keep perspective.

1. Keep your time frame in focus- For investors who are not planning on using funds for 10 or more years the day-to-day volatility is not as important as staying invested for the long term. If you have a time horizon shorter than 10 years you may want to consider reviewing your risk allocation. However it is important to note that a pullback in the market may not be the best time to make big portfolio changes, rather this should be done slowly and purposefully.

2. Focus on your personal goals not short-term performance- While performance gets a lot of attention, and understandably so, it is much more important to know the goal for each pool of money and track to that goal. When we help our clients with planning, we consider and plan for the possibility of market corrections and volatility.

Roth Conversions

While we have no way of knowing how income tax rates and other taxes will be changing in the future, we do anticipate increases at some point. If you are currently in a low tax rate environment or expect to be as you phase into retirement, you may want to consider ROTH conversions as part of your long-term financial planning. When investments are experiencing a market correction or pull-back, it may be a good time to consider this strategy. Why? Because a market drop is a good opportunity to convert larger amounts for less tax. Of course, each person’s financial picture is unique so it is a good idea to consult with your advisor and tax professional prior to making a ROTH conversion.

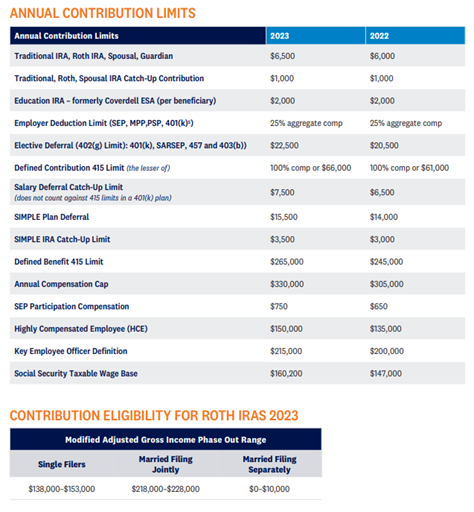

Increased Retirement limits for 2023

Be sure to take advantage of the increased limits in retirement plans for this year. This increase can lead to additional savings for retirement while potentially reducing your taxable income.

Source- LPL Financial 2023

Tax Harvesting-

If you have investments in taxable accounts “Tax Harvesting” can be a way to reduce other capital gains within your finances. What is tax harvesting? In a basic form it is selling specific assets that have a taxable loss in a given year, and ideally investing into other investments that can grow over the long run. This would capture a realized loss for that security, and you use that loss to reduce your taxable capital gains and potentially offset up to $3,000 of your ordinary income for that year. This strategy like the ROTH conversion is something that should be discussed with investment and tax professionals prior to implementing as there are specific rules you need to be aware of.

For those with the timeline and risk tolerance it may make sense to be Opportunistic –

For those with solid emergency savings and a longer time frame a market pullback and increased volatility can provide a good entry point for the long-term investor. Historically when there is a significant pullback you may be presented with buying opportunities of high-quality stocks and bonds, however it is important to have the proper timeline and risk appetite before considering adding to your investments as there are no guarantees for short term returns.

While no one is certain how 2023 will end from an investing standpoint the above-mentioned strategies can be useful ways to proactively plan around your finances. If you would like to discuss any of these ideas in greater detail, please reach out to our team to schedule a meeting with one of our advisors.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.